Taxpayers’ Money That Was NEVER Recovered……

Well we all are aware of the fact that corruption has become a common thing among Politicians, bureaucrats , Banks & Business men and Banks but watching corruption at this boom is surprising for all in India.

In the past, there have been a few people who’ve hurt the country’s economy with corruption and malpractices. And these are just the ones which have been exposed. With so much capital in hand, one can’t help but wonder if India would still had been a developing country had this money been used on what it was actually meant to be spent on.

Now let’s throw some light on the top scams that decimated Indian economy in the recent past.

1. 2G scam (₹1.76 trillion, 2008)

The scam is a combination of three cases, one filed by the Enforcement Directorate and two cases registered by the CBI. In 2008, the government came under the scrutiny when it was alleged that they had undercharged mobile telephone companies for the frequency allocation licenses that were used to create 2G-spectrum subscriptions. In a report submitted by the Comptroller Auditor General of India (CAG) revealed that second generation licenses for mobile networks were given at throwaway prices instead of carrying free and fair auctions.

At the centre of this was the former Telecom Minister A. Raja himself during the second term of the UPA government headed by Manmohan Singh. The CAG stated that “the difference between the money collected and that mandated to be collected was Rs. 1.76 trillion”. In 2012, the Supreme Court declared the scam as “unconstitutional and arbitrary” which further led to the cancellation of over 120 licenses.

2. Commonwealth scam (₹ 2010)

In 2010, the Commonwealth Games held in India gained huge controversy for the corruption involved in the game. It was estimated that only half of the allotted amount was used for the Indian sportsperson. It was also reported that the Indian players were forced to stay in shabby apartments instead of the accommodation allotted to them by the authorities.

In the reports of Central Vigilance Commission, in-charge of Commonwealth scam revealed that Suresh Kalmadi, Chairman of Commonwealth Games 2010 offered a contract of Rs.141 crore to Swiss Timings. All the accused members including Kalmadi were charged of criminal conspiracy, cheating and forgery under the Prevention of Corruption Act.

3. The Fodder scam (1990)

The Fodder Scam was a corruption scandal that involved the embezzlement of about ₹9.4 billion (equivalent to ₹39 billion or US$540 million in 2019) from the government treasury of the eastern Indian state of Bihar. … The scandal led to the end of Lalu’s reign as Chief Minister. The corruption scheme involved the fabrication of a “vast herd of factious livestocks” for which medicines, fodder and animal husbandry equipment was procured.

However, so many people were involved but the main conspirator was Lalu Yadav.

4. The Hawala Scandal (1990-91)

The Hawala Scandal, also known as the “Jain Dairies” case, came to the public limelight in the 1990s, which threw the light on some of the major politicians including L.K. Advani, Yeshwant Sinha, Madan Lal Khurana Arjun Singh for their involvement in a bribery case.

The scam revolved around the Hawala Brothers, who were linked to a raid on Hizbul Mujahideen militants in Kashmir. The money involved was about Rs. 650 millions.

As a result of the case many ruling congress politicians including BJP President L.K. Advani had to find a way to resign from their memberships of the Lok Sabha Assembly.

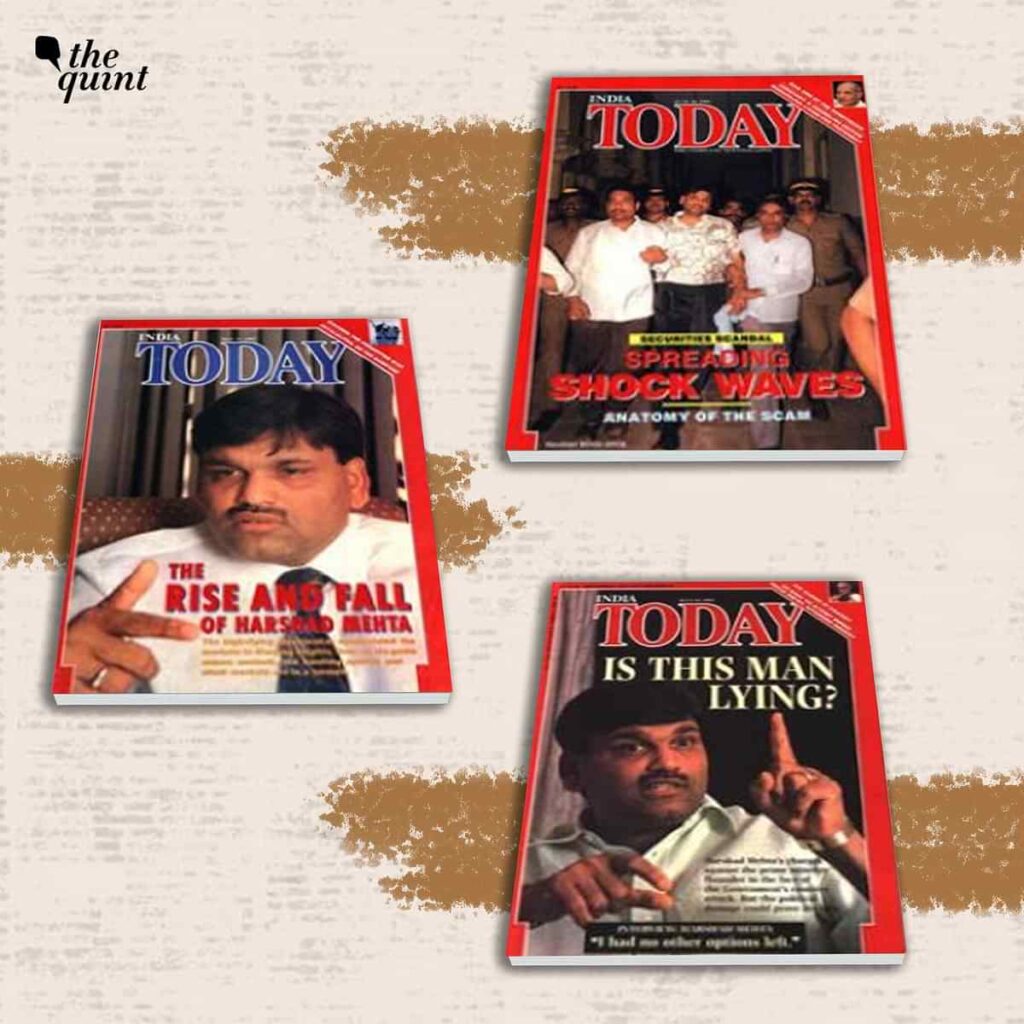

5. Harshad Mehta Scam (1992)

Harshad Mehta scam was the deadliest scam of the Indian Stock Market. Harshad Mehta, a broker, managed to convince the banks to have the cheques drawn in his name. He would then manage to transfer the money deposited in his account into the stock markets. Harshad Mehta then took advantage of the broken system and took the scam to new levels.

Less than 2 months after the scam was exposed, the stock market had already lost a trillion rupees. The RBI created a committee to investigate the matter. The Committee was called the Janakiraman Committee. As per the Janakiraman Committee Report, the scam was of the magnitude of Rs.4025 crores. This impact on the stock market was huge considering that the scam amounted to only 4025 crores in comparison to a trillion or 1 lakh crores. The Year 1991 is generally referred to as the year of progress due to liberalization but if seen from this perspective discussed here it just makes one exclaim “ What a mess!”and also there’s a movie!

6. Indian Coal Allocation Scam (2012)

The coal allocation scam or ‘Colgate’ is a political scandal that surfaced in March 2012, when the UPA government was in power. A number of coal blocks, which were not in the production plan of Coal India Ltd and the Singareni Collieries Company Limited (SCCL), were identified and a list was prepared. In March 2012, a draft report of CAG accused the government of “inefficient” allocation of coal blocks between 2004 and 2009, and estimated the windfall gains to allottees at Rs 10.7 lakh crore.

This was one of the scams that shook the whole nation from its core as many bureaucrats and politicians were involved in this. Although the CAG initially estimated the loss of over Rs 10 lakh crore, the final report mentioned the scam amount was Rs 1.86 lakh crore.

7. Satyam Scam (2009)

This scam of 2009 is also known as ‘India’s Enron Scandal’ and revolves around B. Ramalinga Raju and his Satyam Computer Services Ltd. The company was raided for the manipulation, misinterpretation and falsification of accounts for over Rs. 14,000 crore.

The scam had been the example for following ‘poor’ Corporate Governance practices.

The CBI found 13,000 fake employee records created in Satyam and claimed that the scam amounted to over Rs. 7000 crores. Ten people found guilty in the case are: B Ramalinga Raju; his brother and Satyam’s former managing director B Rama Raju; former chief financial officer Vadlamani Srinivas; former PwC auditors Subramani Gopalakrishnan and T Srinivas; Raju’s another brother B Suryanarayana Raju; former employees G Ramakrishna and some other.

8. Agustawestland Scam (2010)

The AgustaWestland VVIP Chopper Scam, one of the infamous defence scandals in India is a corruption case in which a deal was signed between the UPA government and AgustaWestland for acquisition of 12 helicopters at an estimated cost of Rs. 3600 crore.

It was alleged that bribes were paid to “middlemen” including some politicians and defence officials to tweak the deal in terms of height of the cabin of the helicopter, the operating ceiling, and the maximum altitude of the helicopter.

The scam came to light in 2012. The scam was first uncovered in Italy. In 2013, Bruno Spagnolini, the CEO of AgustaWestland was arrested by the Indian authorities on the charges of bribing middlemen to secure the deal with the Indian Air Force (IAF). However, the deal was cancelled by the congress government in 2014.

9. Vijay Mallya Scam (2016)

There was a time when people used to call him the ‘King of good times’, but today things are far from being good for him.In 2016, Mallya absconded from the country and sought refuge in the UK after he was accused of fraud and money laundering in the country. Vijay Mallya allegedly owes various banks over Rs 9000 crores, which he’d taken as a loan to keep his now defunct Kingfisher airlines from failing. He was recently declared a fugitive economic offender under the Fugitive Economic Offenders Act.

While the Indian government is trying to extradite him from the UK, which does not seem to be happening anytime soon.

10. Nirav Modi Bank Fraud Case (2018)

Nirav Modi, a Diamond Businessman and his relatives including his maternal uncle Mehul Choksi were involved in using fraudulent letters of undertakings worth Rs. 10,000 crore issued by the Punjab National Bank.

Nirav Modi and his relatives escaped India in early 2018, days before the news of the scam became public. PNB scam has been dubbed as the biggest fraud in India’s banking history.

In 2018, PNB filed a case with CBI accusing Nirav Modi and the companies he was connected to of obtaining Letters of Undertaking (LoUs) from PNB without paying up the margin amount against loans. This meant that if those companies failed to pay the loan, PNB would have had to pay the amount.

As of 2018, the scam has ballooned to over Rs 14,000 crore. Mehul Choksi ran to Antigua for shelter while Neerav stayed in London.

– Radha Agrawal